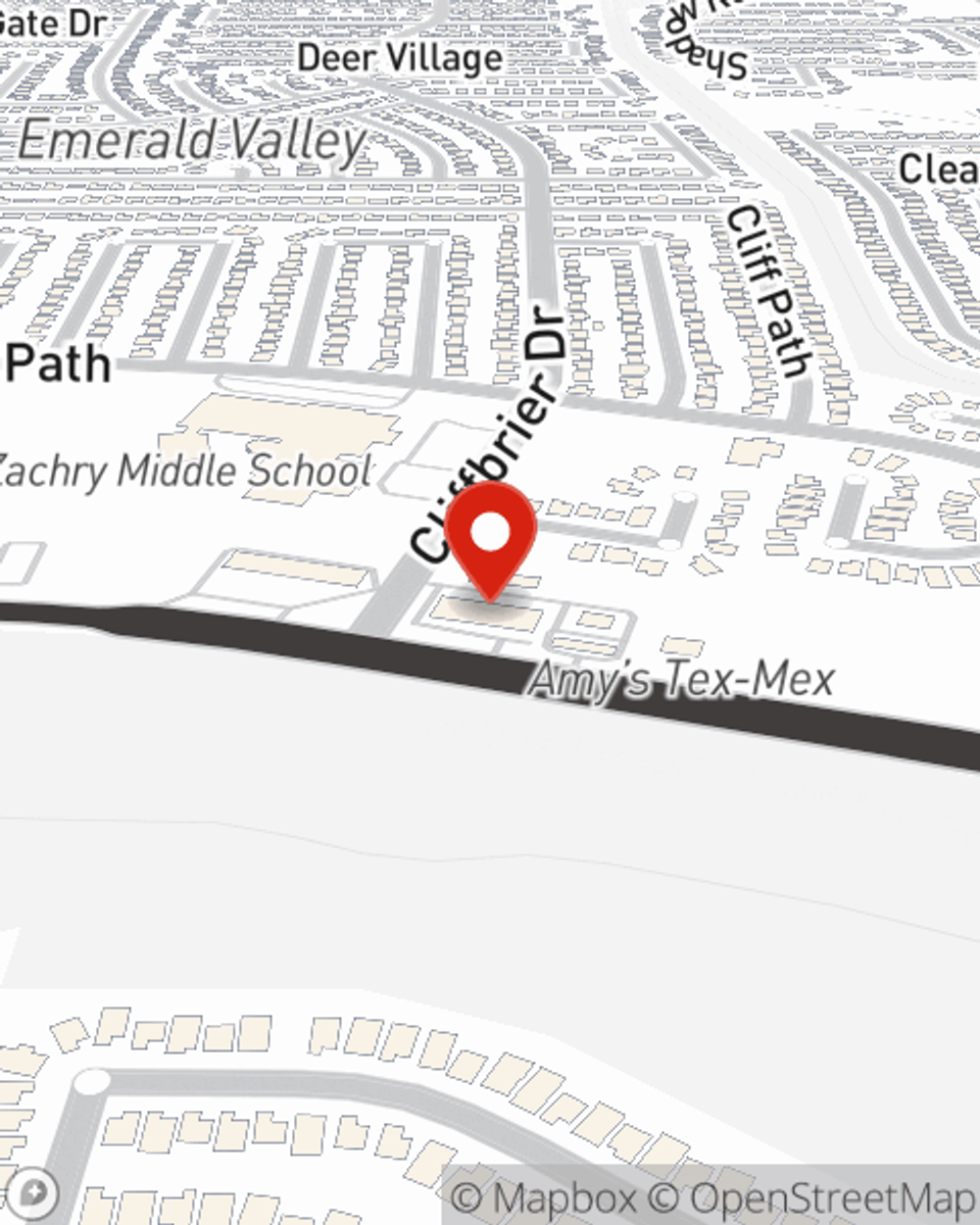

Life Insurance in and around San Antonio

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

- San Antonio

- Castroville

- Helotes

- Converse

- Schertz

- Boerne

- Cibolo

- Live Oak

- Leon Valley

Your Life Insurance Search Is Over

Providing for those you love is a big deal. You advise them on important decisions go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Get insured for what matters to you

Life happens. Don't wait.

Love Well With Life Insurance

Some of your options with State Farm include coverage for a specific number of years or coverage for a specific time frame. But these options aren't the only reason to choose State Farm. Agent Natalie Reyes's terrific customer service is what makes Natalie Reyes a great asset in helping you pick the right policy.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to find out what a State Farm policy can do for you? Visit State Farm Agent Natalie Reyes today.

Have More Questions About Life Insurance?

Call Natalie at (210) 684-4327 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Natalie Reyes

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.